It is imperative that opportunities to tackle climate change and create well-paying jobs in the United States exist concurrently. As the country’s economy changes and the prevalence of carbon-free energy sources grows, it has become increasingly important to understand how employment in the energy sector is also growing and changing. The U.S. Energy and Employment Report (USEER) provides a comprehensive summary of national and state-level employment, workforce, industry, occupation, unionization, demographic and hiring information by energy technology groups. Beginning in 2016, the annual study combines surveys of businesses with public labor data to produce estimates of employment and workforce characteristics.

Employment statistics post-2020 in any field must be considered in tandem with pre-pandemic numbers to get the full picture of how the job market is (or is not) recovering from the impacts of COVID. Prior to the pandemic from 2015 to 2019, the annual growth rate for energy employment in the U.S. was 3%, whereas general job growth was 1.5%. The energy sector lost approximately 840,000 jobs because of the pandemic in 2020, a more dramatic shrinkage than jobs economy-wide across the country. By the end of 2020, the energy sector began to rebound, although it has not fully recovered yet. Overall, the U.S. energy sector in 2021 grew 4.0% compared to 2020, outpacing general U.S. employment once again, climbing only 2.8% over the same period.

The USEER defines the Energy Efficiency sector as jobs involving building design and contracting services that provide insulation, improve natural lighting and otherwise reduce energy consumption in residential and commercial areas. Further, the EE sector includes employment in the manufacture of ENERGY STAR(R) products. To clarify further, the figures of the report for this sector include only work with efficient technologies, designs and retrofits. It notably does not include employment related to energy-efficiency manufacturing processes nor direct employees of utility companies that are involved in the implementation of internal energy efficiency programs.

According to the USEER, in 2021, EE employed 2,164,914 workers, a 2.7% increase from 2020. This 2.7% growth of EE is equivalent to 57,740 jobs. Further, EE is one of two USEER categories that does not contain a technology that lost jobs in 2021. The other is Transmission, Distribution and Storage. Despite this increase, the sector is still left with 213,978 fewer jobs than prior to the pandemic.

Even as EE jobs are added back, a persistent issue in the EE sector is hiring difficulties, as reported by 80% to 91% of employers in related industries: construction, manufacturing, wholesale trade, distribution and transport and professional business services. All the listed industries indicated that competition or small applicant pool are the primary reasons that it is difficult to hire. All but manufacturing reported problems due to insufficient skills or education or training as the next two reasons; manufacturing reported significant problems competing with other employers due to wages.

Apart from hiring difficulties, the USEER highlights some key national trends and takeaways:

- Traditional HVAC, the largest EE technology, added the most jobs of any category, 17,740 (or a 3.3% increase from 2020).

- The largest gains were in the construction industry, with 25,131 new jobs (2.2% growth).

- Construction had the highest percentage of companies reporting hiring difficulty, with 91% of respondents indicating that it was “very difficult” or “somewhat difficult” to find employees.

- EE’s workforce tends to be disproportionately male, with 74% compared to 53% nationally.

- Black or African American workers are underrepresented, making up 8% of the workforce compared to 12% of the overall U.S. workforce. Hispanic workers also comprise less than the workforce average, 16% compared to 18% of the country’s overall workforce.

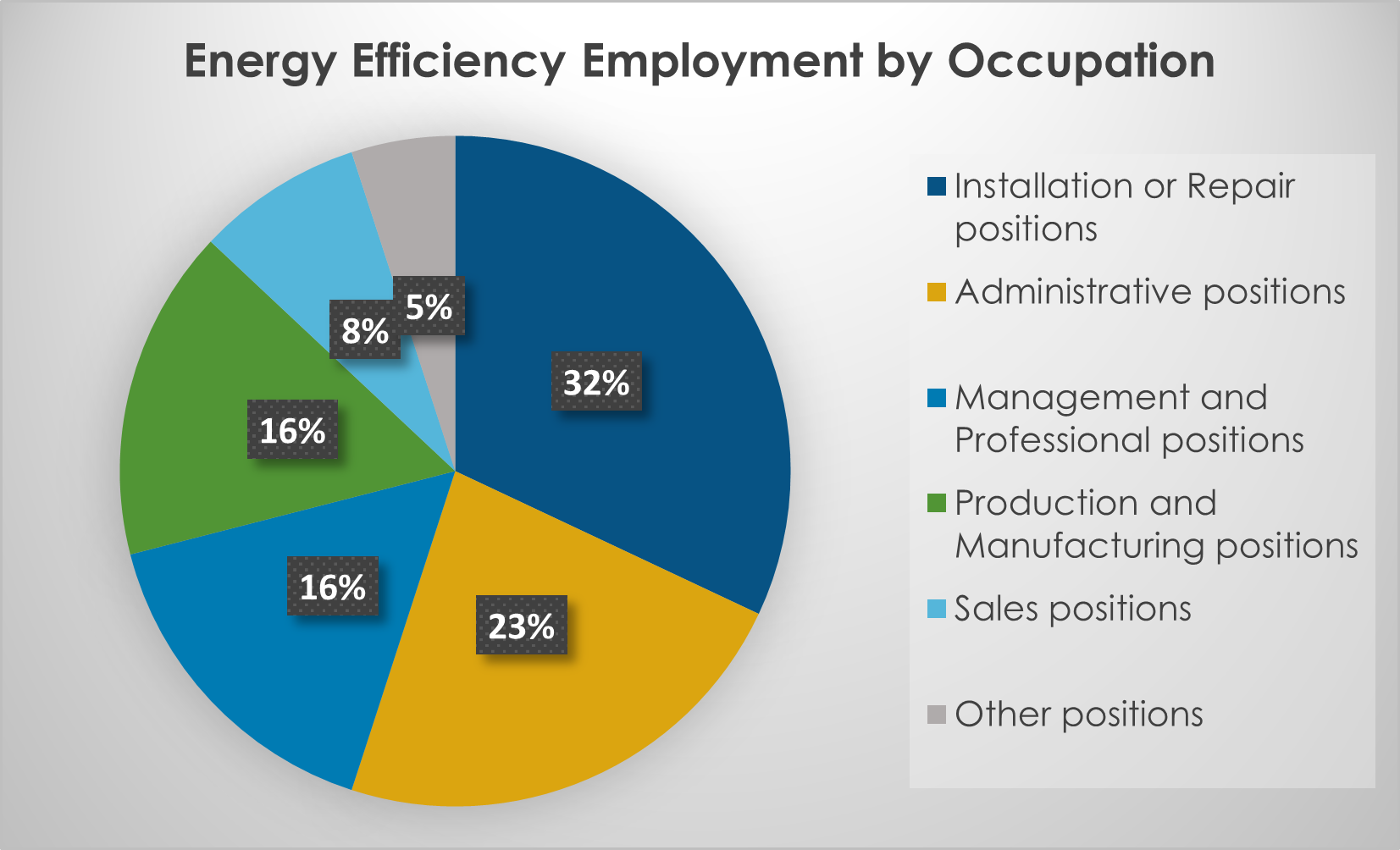

- The largest occupation group within EE was installation or repair positions, at 32%. A further occupation breakdown is shown in the chart below.

Source: USEER 2022 National Report

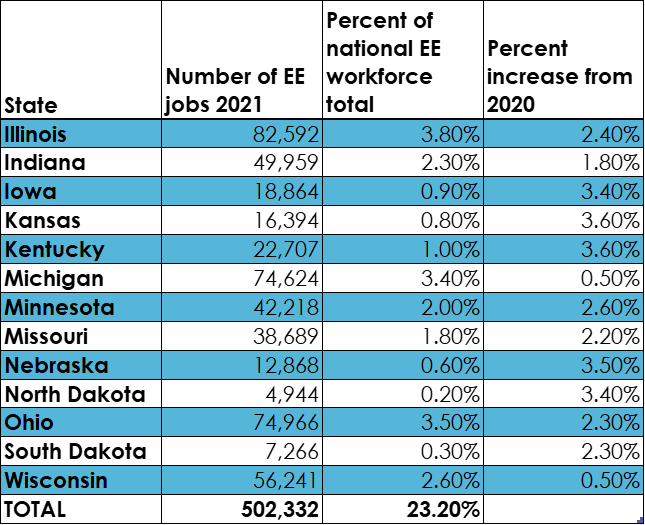

The Midwest is home to 502,332 EE jobs, equivalent to 23.20% of the national EE workforce. Additional Midwest specific data from the State-level USEER:

The continued recovery of energy sector jobs (and EE jobs) in a post-COVID world is promising. Despite hurdles, the growth highlights a positive outlook for the transformation of the U.S. economy. Clear opportunities exist to engage underrepresented groups with relevant training for career paths, showing that workforce development is a key component of a further economic rebuild. The development of EE-related technologies is important not just for the jobs required to create these, but also to furthering the industry overall.