We all know that the cheapest kilowatt is the one not used, but how is energy efficiency actually valued? The organizations that operate electricity markets, the Regional Transmission Organizations (RTOs) and Independent System Operators (ISOs) have a large hand in customer rates and therefore, the price of energy efficiency. With that in mind, we thought it would be a great time to discuss RTOs, ISOs and the structure of our energy markets.

What are RTOs and ISOs?

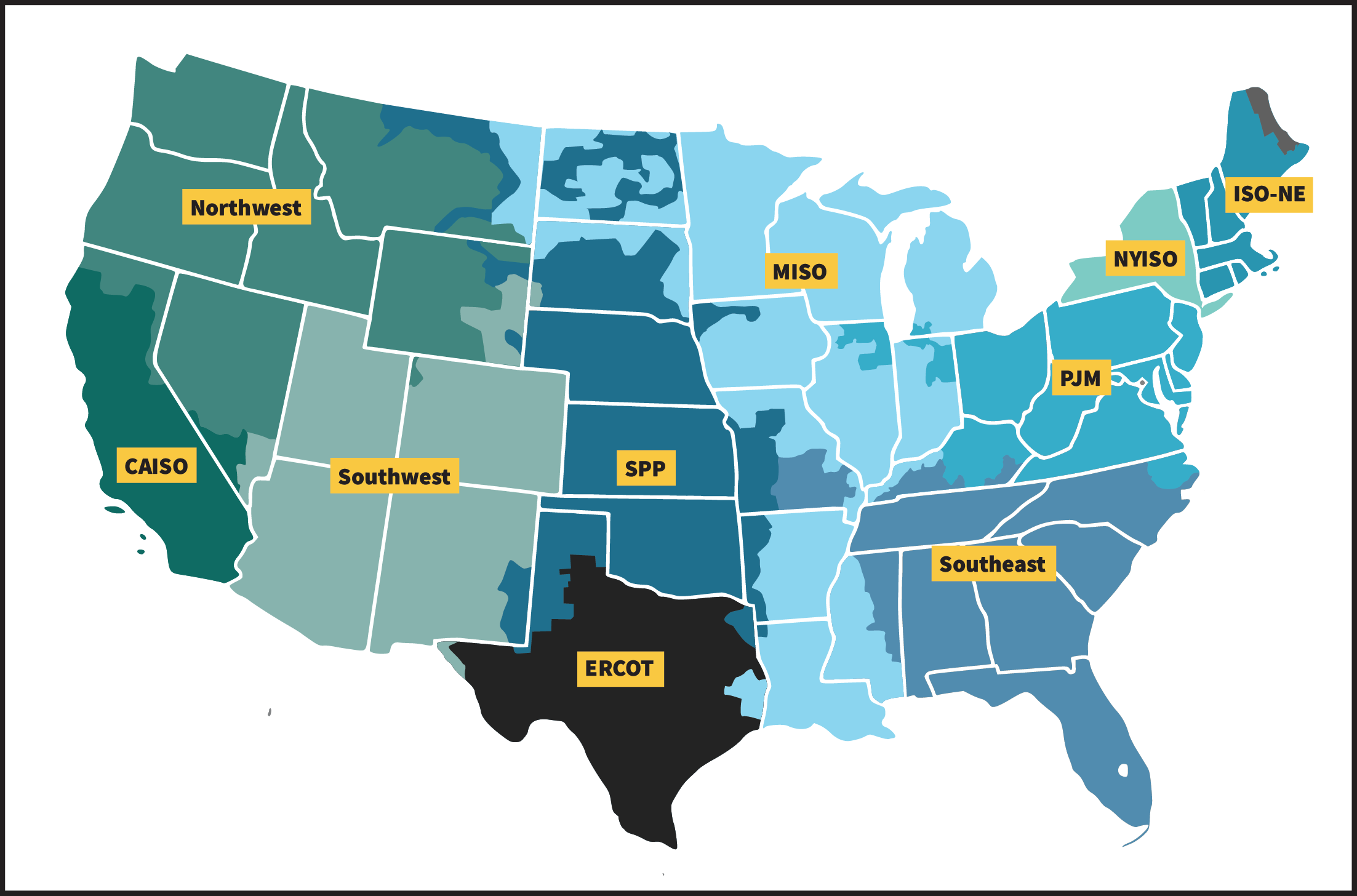

While there are some subtle differences between the two, both RTOs and ISOs are nonprofits that operate the transmission system and administer wholesale energy markets in their service territories. There are three ISOs and four RTOs in the U.S., each with their own exclusive territory. Most of the country, roughly two-thirds of the population, is served by an ISO or RTO. In areas without an ISO or RTO, utilities must perform all the functions of an ISO/RTO. The map below displays the service areas of the ISO/RTOs as well as the three regions – Northwest, Southwest and Southeast – where there is no ISO or RTO.

Map: Federal Energy Regulatory Commission RTOs and ISOs | Federal Energy Regulatory Commission (ferc.gov)

Within MEEA’s 13 state territory there are three RTOs: the Midcontinent Independent System Operator (MISO), PJM Interconnection (PJM) and the Southwest Power Pool (SPP). Parts of Missouri and Kentucky are not served by an RTO and their vertically integrated utilities can participate in bilateral electricity sales in the Southeast region. There is also a small region of South Dakota that is not part of the SPP.

The Federal Energy Regulatory Commission (FERC) encouraged the creation of ISOs in Orders 888 & 889 and RTOs in Order 2000 in the late 1990s. Because ISOs and RTOs operate the transmission and sale of electricity across multiple states, they are federally regulated by FERC. The way each ISO and RTO operates the energy market for their service territory varies by organization.

Energy Markets

We have two types of energy markets in the United States: regulated and deregulated (also called restructured). In a regulated energy market, utilities are typically vertically integrated monopolies meaning they own and operate generation and, transmission and distribution of electricity. Most states in the Midwest have a regulated energy market with vertically integrated utilities meaning customers cannot choose the source of their electricity. By contrast, in a deregulated or restructured energy market, utilities are typically only responsible for transmission and distribution of electricity. In these markets other entities generate power and sell electricity to the utilities in a competitive wholesale market. In the Midwest, Illinois, Michigan and Ohio have deregulated electricity markets.

While the structure of the energy market – be it regulated or deregulated – varies by state, the type of wholesale electricity market varies by ISO/RTO. Each ISO/RTO operates wholesale electricity markets where power generators and utilities buy and sell the electricity they will need to supply to end-use customers on the retail market. There are several different types of wholesale electricity markets.

- On the day-ahead market, utilities use load forecasts to buy the electricity they think they will need the following day. Power generators make a commitment to be online to produce the electricity they’ve sold for the following day.

- The real-time market allows the ISO/RTO ensure reliability by facilitating the sale of electricity for near immediate delivery (usually between 5 and 15 minutes) in the event of any increased demand.

- Some ISO/RTOs also use capacity markets to ensure grid reliability. A capacity market seeks to ensure there will be enough energy supply to meet future demand. Entities on the capacity market place bids in a competitive auction for their resources to be available for generation in the future.

In the Midwest both PJM and MISO operate capacity markets while the SPP does not. PJM’s capacity market takes place three years ahead of a given service year and participating entities commit to making their resources available three years into the future. Energy efficiency resources also participate in capacity markets, making commitments to be available to reduce demand in the future. Power suppliers in the capacity market are paid for making their resources available to provide electricity or reduce demand if needed. This is separate from payments these suppliers receive for the electricity they generate.

On Friday, September 6th, PJM filed a proposal with FERC to eliminate energy efficiency resource participation from their capacity market. In the next blog we’ll discuss how energy efficiency has historically participated in wholesale capacity markets and some recent energy efficiency related complaints filed with FERC. Stay tuned.